Fence Financing

Fence Financing: A Smart Choice for Illinois Homeowners

Home improvement projects can be a significant investment, and one essential aspect of many homes in Illinois is fencing. Whether you're looking to enhance privacy, increase security, or add aesthetic appeal, a fence is a valuable addition. However, the cost of installing or upgrading a fence can be substantial, leading many homeowners to seek financing options. Fence financing offers a practical solution, making it easier for Illinois residents to afford quality fencing without straining their finances. This article explores the benefits of fence financing and how it can be advantageous for homeowners in Illinois.

Understanding Fence Financing

Fence financing involves securing a loan specifically for the purpose of installing or upgrading a fence. This financing can cover various types of fences, including wood, vinyl, aluminum, and chain link. Companies like 76 Fence offer financing options through partnerships with financial institutions, making it easier for homeowners to manage the cost of their fencing projects.

Benefits of Fence Financing for Illinois Homeowners

Immediate Home Improvement

- One of the primary benefits of fence financing is that it allows homeowners to start their projects immediately. Rather than waiting to save enough money, financing enables you to enjoy the benefits of a new or upgraded fence right away.

Flexible Payment Options

- Financing options typically come with flexible payment plans. Homeowners can choose a plan that fits their budget, spreading the cost over several months or years. This flexibility ensures that the project is affordable and manageable.

0% Financing Options

- Some financing plans offer 0% interest rates for a certain period. This means you can finance your fence without paying extra in interest, making it an incredibly cost-effective option.

Enhanced Property Value

- A well-installed fence can significantly enhance the value of your property. By financing your fence, you're making an investment that can pay off when it's time to sell your home. A fence adds curb appeal and is an attractive feature for potential buyers.

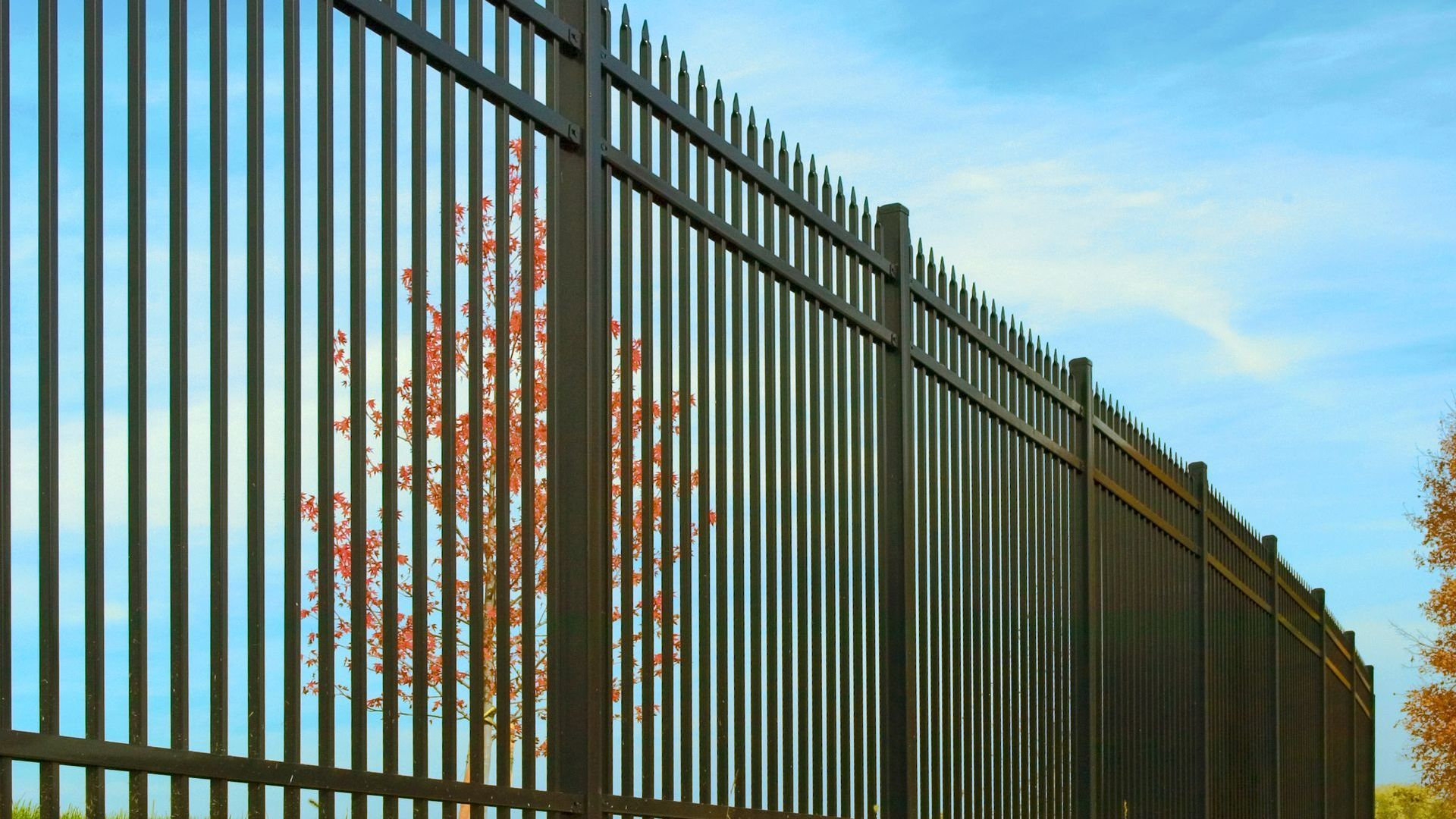

Increased Security and Privacy

- Fences provide essential security and privacy for homeowners. Financing allows you to invest in high-quality materials and professional installation, ensuring that your fence is durable and effective in providing the security and privacy you need.

No Home Equity Requirements

- Unlike some home improvement loans, fence financing often does not require you to use your home as collateral. This reduces the risk and makes it easier to qualify for financing.

Financing Options Available

1. Wisetack Financing

- 76 Fence has partnered with Wisetack to offer financing built into their quotes. Homeowners can use Wisetack's payment calculator to see if they qualify and find a payment plan that suits their needs.

2. FinanceMyProject

- Another option available is through FinanceMyProject, which offers unsecured home improvement loans. Benefits include borrowing up to $50,000, flexible loan terms, and quick application processes without affecting your credit score.

3. Acorn Finance

- Acorn Finance provides a platform where homeowners can get pre-approved for financing within seconds. This option is particularly beneficial for those who want to compare different loan offers quickly and choose the best one.

Steps to Secure Fence Financing

- Get an Estimate

- The first step is to get an estimate for your fencing project. This will give you an idea of the total cost and help you determine how much financing you need.

- Apply for Financing

- Once you have an estimate, you can apply for financing through the available options. The application process is typically quick and straightforward, with many platforms offering instant pre-approval.

- Choose a Payment Plan

- After approval, you can choose a payment plan that fits your budget. Consider factors like the interest rate, monthly payments, and the total repayment period.

- Start Your Project

- With financing secured, you can proceed with your fencing project. Professional installation ensures that your fence is built to last and meets your specific needs.

Important Considerations

- Credit Score

- Your credit score can impact the terms of your financing. Higher credit scores often qualify for better interest rates and more favorable terms.

- Interest Rates

- Be sure to understand the interest rates associated with your financing plan. While 0% financing options are available, some plans may have higher rates depending on your creditworthiness and the lender.

- Loan Terms

- Review the loan terms carefully. Consider the repayment period and ensure that the monthly payments are affordable within your budget.

Fence Financing in Illinois

Fence financing is a practical solution for Illinois homeowners looking to improve their properties without the burden of upfront costs. With flexible payment options, 0% financing plans, and the ability to enhance property value, financing makes it easier to invest in a high-quality fence. By partnering with reputable financial institutions, companies like 76 Fence Illinois provide homeowners with the resources they need to achieve their home improvement goals. Whether you're enhancing security, privacy, or aesthetic appeal, fence financing can help you make your dream project a reality.

For more information on fence financing options, visit our Financing page.

Fence Installation Blog

How to Upgrade Your Chain Link Fence with Privacy Slats: Benefits, Styles & Installation in Illinois